Different companies use different accounting books (purchase ledger/purchase journal/accounts payable, sales journal/sales ledger/accounts receivable, cash receipts journal, cash payments journal/cash book etc.) depending on the type of company. īefore transferring and classifying transactions in the general ledger, first they must be recorded in the accounts books.

The expenses listed on the income statement can come from the general ledger accounts for expenses such as interest charges and advertising. The “ income ” in income statement can include figures from the general ledger accounts for cash, inventory and accounts receivable. Find out more in our post on income statements. The accounts on the general ledger correspond to the accounts on the income statement and balance sheet, which is where this information will ultimately end up. In this accounting method, an accounting entry is made in the credit of one account and the debit of another at the same time, for the same amount. The general ledger uses the double-entry accounting system : each transaction is logged under two accounts at once. You should be especially motivated to stay on top of your paperwork if you’re a sole-proprietor or a sole-trader, or you’ll be kicking yourself 6 months down the line when you’re dealing with a jumbled backlog of transactions to record… Think of general ledger as a bird’s eye view of your business, while a journal is more like the reference section in an academic paper, you can see exactly when and where the information came from, with plenty of detail.

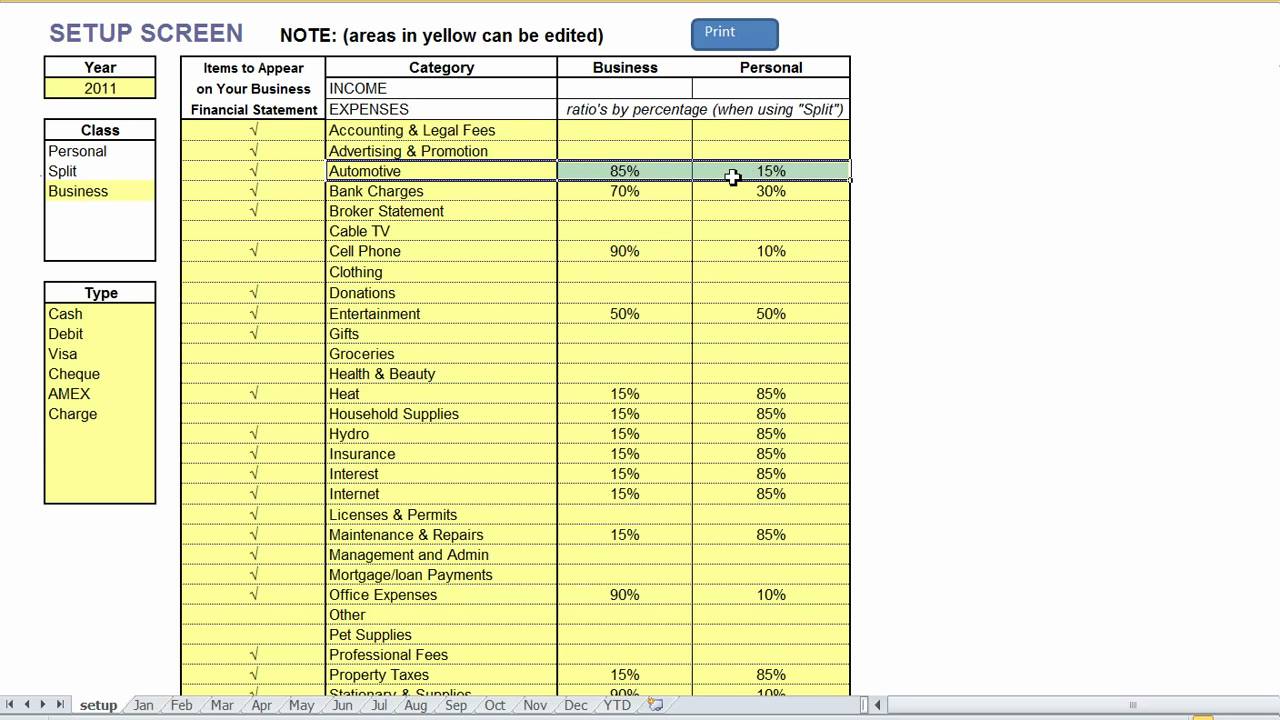

Accounts can include assets, liabilities, revenues, expenses, gains and losses. A chart of accounts lists all of the accounts recorded in the general ledger, which can range from just a few account categories in a small business, to thousands of categories in a large company. These financial transactions (or accounts entries ) are detailed and grouped in the general ledger by their account class or sub-ledger account, according to the company’s chart of accounts. Specifically, it is used for recording all of the financial transactions. The general ledger (sometimes abbreviated to GL, and also known as an accounts book ) is a master accounting document which allows you to see the financial position of a company as a whole. Keep reading to learn more about the general ledger and how you can use it in your small business.

#How to do a ledger book how to#

But what exactly is a general ledger a nd what is it used for? In this article we explain how to complete a general ledger and how best to use it. The general ledger has been at the core of accounting for centuries, being essential for financial management and success in companies large and small alike.

0 kommentar(er)

0 kommentar(er)